International trade or trading across different continents required the service of trusted international payment facilitator like Godwin Procurement Services (GPS).

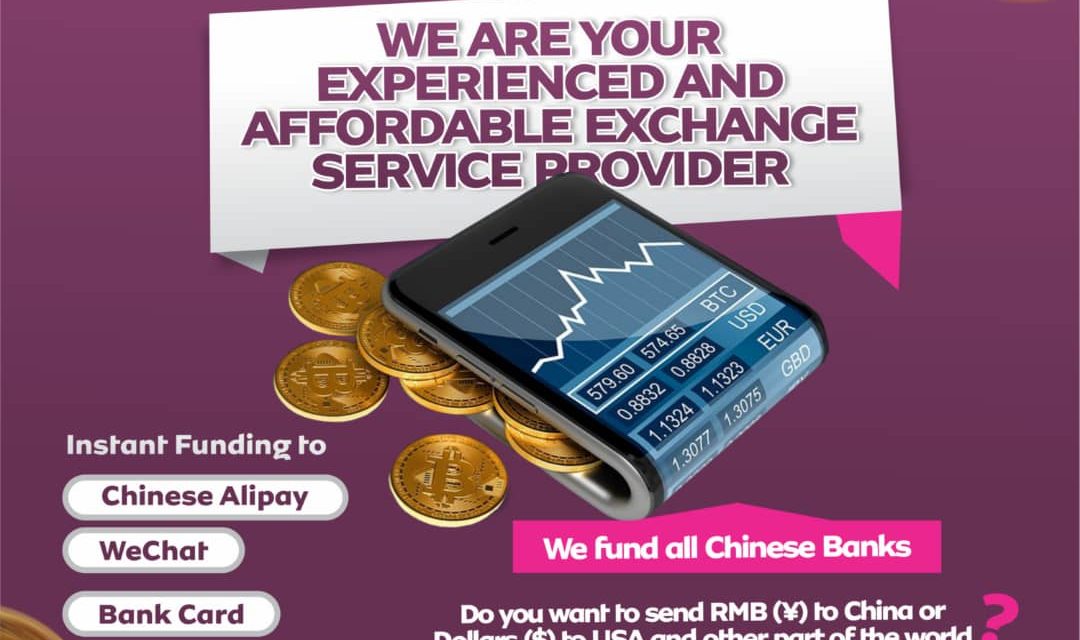

Godwin Procurement Services offers affordable exchange service to clients who wishes to settle their international payment with trading partners or companies. GPS is an experienced handler and a sure plug for international payment and handling of logistics services.

Godwin Procurement Services enables the conversion of one currency into another. At Godwin Procurement Services, we believe this is crucial for businesses engaged in global trade or individuals involved in international transactions.

Godwin Procurement Services offer competitive exchange rates and low fees, making it more convenient and cost-effective to convert currencies. We provide payment solutions that allow businesses and individuals to make and receive payments globally. GPS support various payment methods, including wire transfers, electronic fund transfers (EFT), and online payment gateways. These services help streamline cross-border transactions, reduce transaction costs, and mitigate currency risks.

When it comes to risk management, Godwin Procurement Services offers tools to manage currency risks associated with fluctuating exchange rates through provision of access to hedging instruments such as forward contracts, options, and swaps. These tools can help businesses protect themselves against adverse currency movements, ensuring more predictable financial outcomes.

Godwin Procurement Services offers logistics support. This can include features like shipping management, customs documentation assistance, and tracking capabilities. The aforementioned services aim to simplify the movement of goods across borders, ensuring smooth supply chain operations.

At Godwin Procurement Services, we adhere to relevant regulatory requirements and compliance standards. More importantly, regulatory agency offer guidance and support regarding international trade regulations, sanctions, anti-money laundering (AML), and know your customer (KYC) requirements. We understand that ensuring compliance with these regulations is crucial for businesses engaged in cross-border transactions.